tn franchise and excise tax number lookup

If there are any problems here. Tax credits offset tax liability.

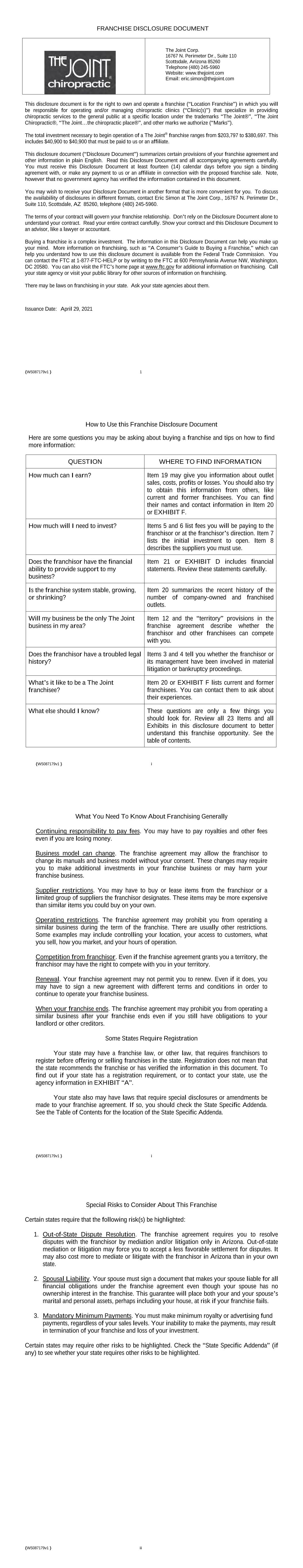

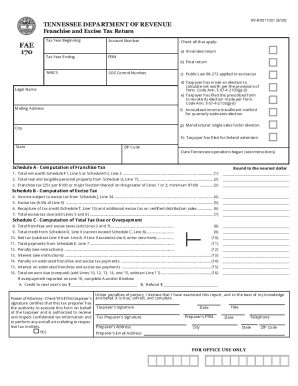

F1304601 Fill Online Printable Fillable Blank Pdffiller

Please be aware that some links in these.

. For Account Type choose Franchise Excise Tax. Input the Contacts name phone number and email address. It can be accessed.

The following entity types may be required to file the franchise and excise tax return. Unlike other taxes a business does not need to have a profit or sales. For more information view the topics below.

All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business conducted in Tennessee for the fiscal. Number or identifier to store on file prior to initiating payments through this FE on-line application. Departments Franchise and Excise Tax Manual.

There are several ways a farm business may be exempt from the. Franchise and Excise Tax Exemptions. You may look up your professional privilege tax account ID by visiting our tax filing website the Tennessee Taxpayer Access Point TNTAP.

What is the TN franchise tax. The book value cost less accumulated depreciation of real. In general the franchise tax is based on the greater of Tennessee apportioned.

Franchise and excise tax. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242. Go to Tennessee Franchise Tax Account Number Lookup website using the links below.

Account Number Online Search. The Department of Revenue recently updated its website platform and as a result individual website links have changed. Fill in the Taxpayer ID Type ID and Account ID.

F. Franchise Excise Tax. Franchise Excise Tax - Credits.

If you have questions about Franchise And Excise Tax Online contact. TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence. Temporary Number A temporary number is an.

Enter your Username and Password and click on Log In. This seven-digit number is assigned sequentially by the Secretary of State when a company registers to do business in Tennessee. Net worth assets less liabilities or.

You can search for your account number for the following tax types on Tennessee Taxpayer Access Point TNTAP. Tennessee Department of Revenue Attention. This can be resolved by providing the bank with the following 10-digit Company I.

A franchise tax is a tax for having the right to do business in Tennessee.

Fill Free Fillable Forms State Of Tennessee

Tennessee Franchise Excise Tax Filings Ilsa Insurance Licensing Services Of America Inc

Capitol Hill Weekly Wrap Archives Page 9 Of 12 Tennessee Senate Republican Caucus

Tennessee Tax Revenues Down Localmemphis Com

Historical Tennessee Tax Policy Information Ballotpedia

Franchise And Excise Tax Exempt Entity Disclosure Of Activity 2009 Form Fill Out Sign Online Dochub

Fill Free Fillable Forms State Of Tennessee

Fill Free Fillable Forms State Of Tennessee

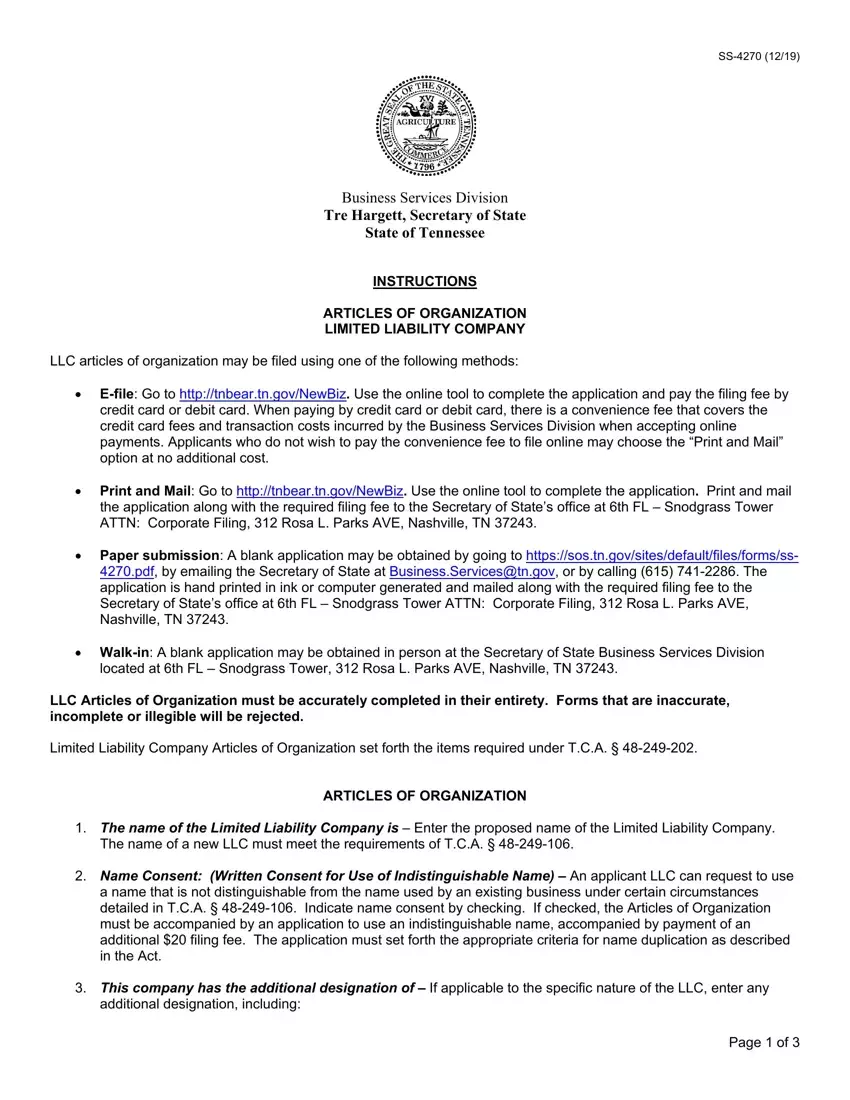

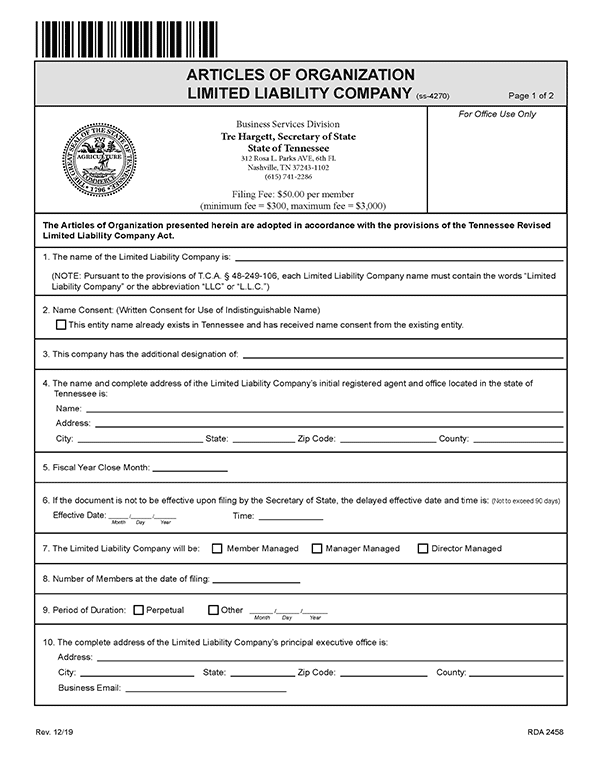

Tennessee Articles Organization Pdf Form Formspal

Llc Tennessee How To Start An Llc In Tennessee Truic

Uncategorized Archives Page 2 Of 11 Blount County Industry

How To Start An Llc In Tennessee Legalzoom

Tennessee Cleaning Business Start Up Laws

Tn Franchise Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

Franchise And Gross Receipts Capital Stock Franchise Taxes Net Worth Taxes And Gross Receipts Studocu

Business License Grainger County Tennessee County Clerk